Stop telecoms fraud in its tracks with Fraud Protect

Tollring’s innovative fraud and credit management solution seamlessly integrates with leading hosted voice / SIP trunking platforms

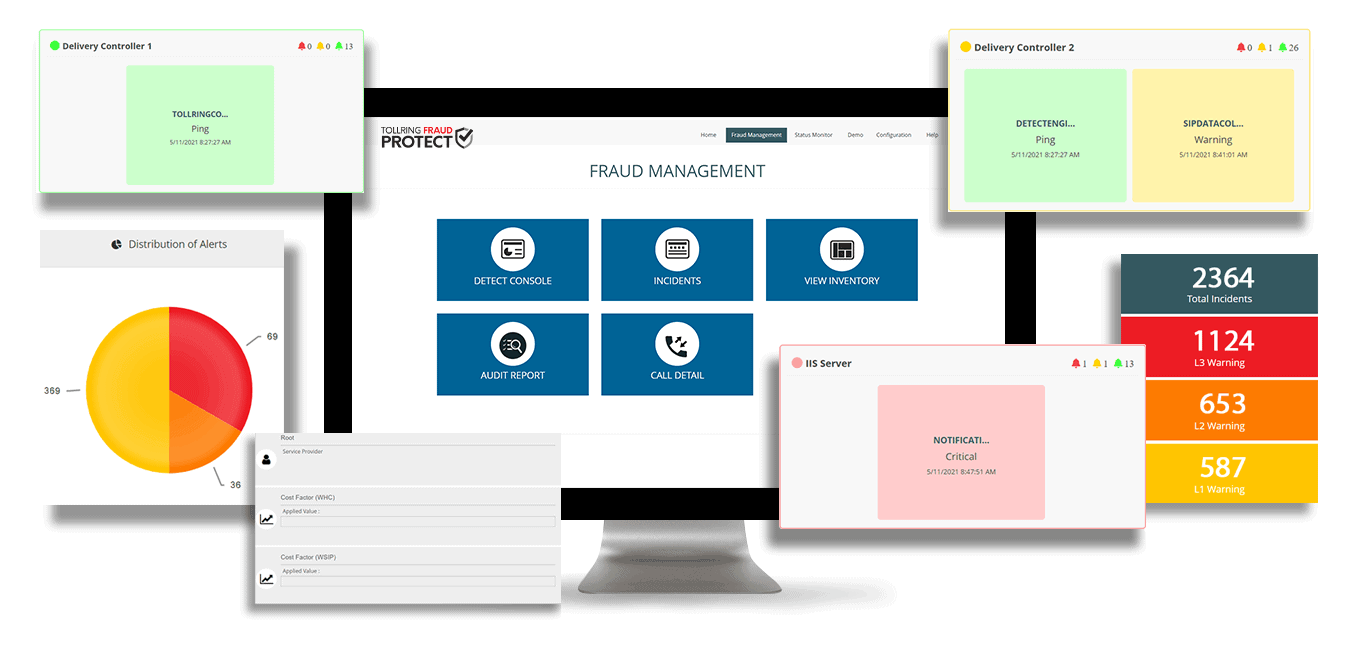

Service providers benefit from automated real-time monitoring and alerts with predictive analysis of trends, to protect against fraud attacks.

Tollring’s powerful self-learning fraud and credit management solution detects incidents and protects from telecoms fraud on hosted voice and SIP trunking platforms. This scalable and easy to deploy carrier-grade solution is proven to offer comprehensive and intelligent real-time capability.

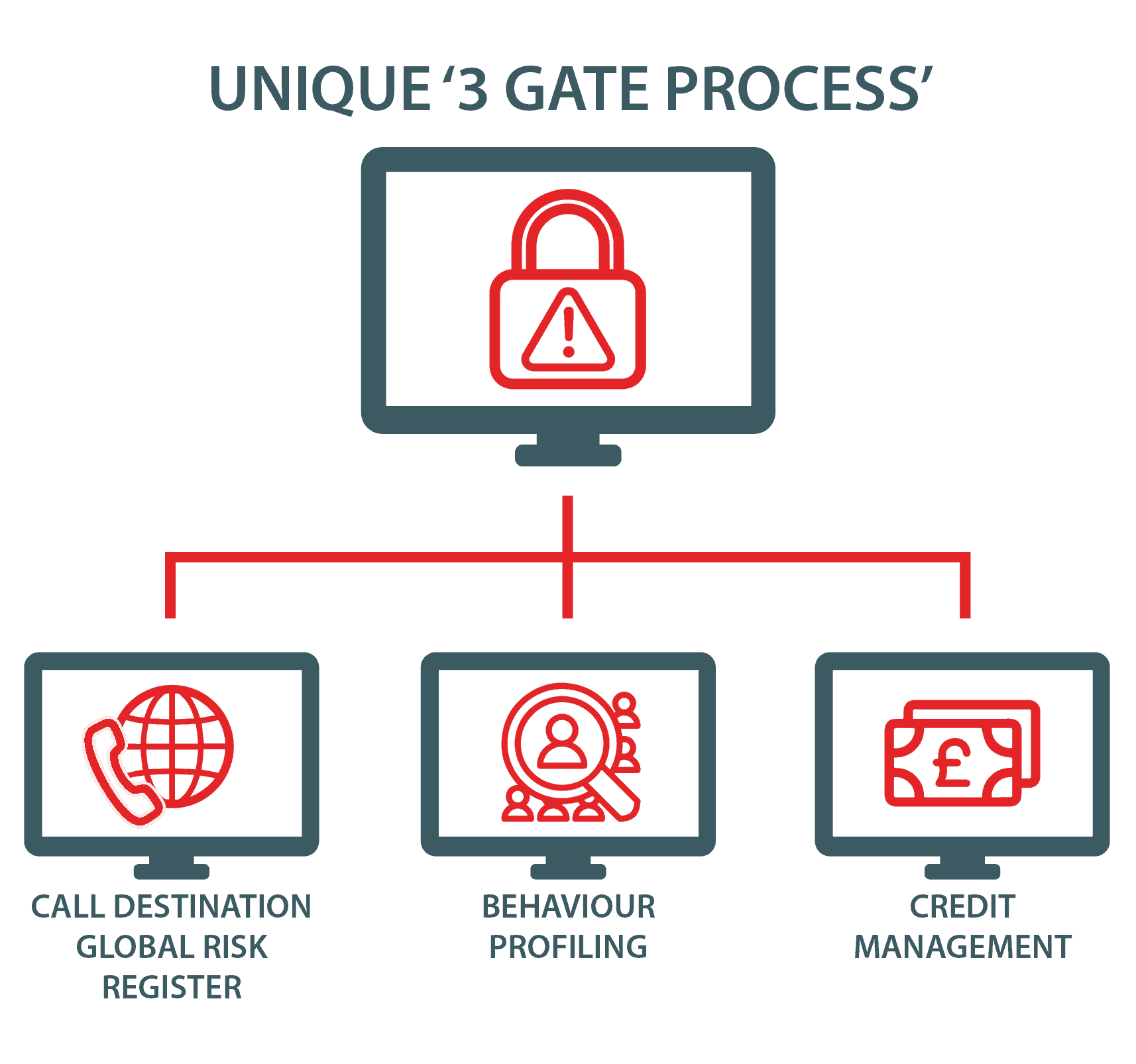

The solution machine-learns and uniquely combines a rigorous process of risk register and fraud rule checks, historical trend analyses and blacklisted destination reviews, in line with preset credit limits – on every call made.

Our Stats

Tollring Fraud Protect monitors millions of endpoints worldwide

Protect your customers from telecoms fraud and ‘bill shock’ with intelligent real-time analytics

The solution monitors behavioural patterns and call trends to implement rules, trigger alerts and automatically block calls. Notifications of incidents are triggered on breach, mitigating risk at the earliest opportunity. When live calls in progress are terminated, dial plans are updated at site-level to prevent further attempts. Credit management becomes the final gatekeeper in the process, constraining spend to manage exposure, and full audit reporting provides peace-of-mind.

Maintain your competitive edge and build customer confidence

Multi-tier configuration of rules/rule assignments includes the ability for a service provider to permit reseller access to self-provision spend/credit limits, which reduces time spent on admin. The solution is shipped with an extensive database of known fraudulent/black-listed destinations, then self-learns to recognise anomalies, becoming more powerful and ‘up to date’ day-by-day.

This cutting-edge fraud and credit management tool may be deployed in your data centre or as a Service (SaaS) and can be white-labelled for differentiation.